According to the forecast, in 2036 the National Insurance will not be able to pay the public their full rights under the law

Among the solutions that have emerged in the past to improve the actuarial situation is a proportional and fair linkage of the retirement age to life expectancy, government participation for beneficiaries of exemptions and discounts on national insurance contributions, returning funds taken from the National Insurance Institute to the State Treasury, and more.

Under the National Insurance Law, every 3 years the actuary of the organization must present a report with a forecast of benefits and allowances paid to Israeli residents in accordance with the law, as well as the ability to meet obligations and rights granted by law.

The report published recently is adapted to the end of 2022 and, at the request of the Minister of Labor, Yoav Ben Tzur, shall be updated and include the parameters that have changed in the wake of the war in order to get a picture that is more accurate and relevant to the current reality.

However, according to the existing report, which is based on the distribution of work income, the real increase in wages, the share of insurance contribution payers, a forecast of interest rates received by the National Insurance on state investments in bonds and the Bank of Israel's forecast regarding unemployment rates, it was found that from 2023 payments are expected to exceed receipts and part of the benefit payment will be taken from the principal.

- As of 2030 – the National Insurance is anticipated to perform an early redemption of part of the principal and to utilize these sums, that are estimated to be billions of shekels, to fulfill its full payment obligations.

- In 2036 – the principal is expected to be depleted, and without additional funding or the return of the funds taken to the State Treasury – the National Insurance will not be able to pay its full obligations under the law – to the residents of Israel.

According to the forecast, based on the report adapted to the end of 2022, in 2023 the National Insurance will pay allowances totaling about NIS 118 billion, including: disability pensions, work disability allowances, maternity allowances, unemployment benefits, old-age pensions, burial expenses, survivors' pensions and more, and the rest of the principal at the end of this year will reach about NIS 245 billion. As a result, the overall level of coverage for 2023 will be 2.09.

As mentioned, the forecast did not include the war expenses that are divided into 2 main areas. First, the payment of "insurance" allowances which are granted to the citizens as they pay their insurance contributions on a regular basis. The second area is the payment as part of government decisions and assistance that the State Treasury needs to compensate the National Insurance and return the funds paid.

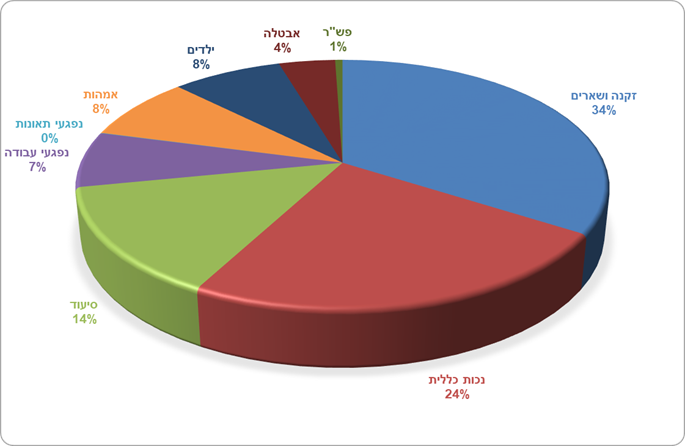

Distribution of all payments between the branches – 2023

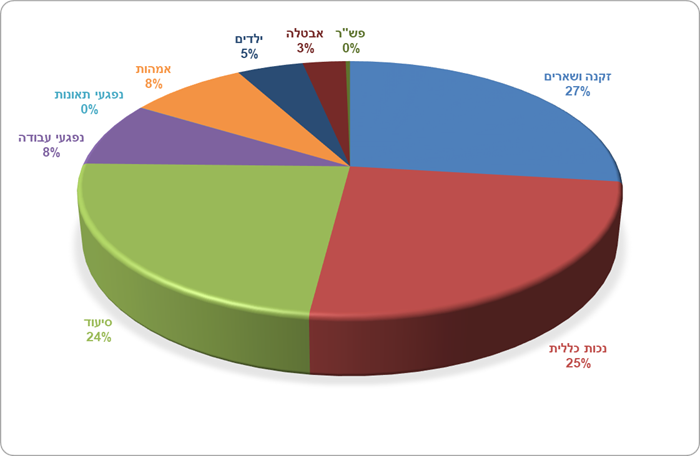

Distribution of all payments between the branches – 2060

As may be recalled, even before the Coronavirus crisis, the National Insurance raised this issue with the public and the government and asked to address this matter and ensure the continuation of the public's right over the years. In addition, the National Insurance sought to examine the interest rate unilaterally modified by the Ministry of Finance and to verify the maximization of profits for the benefit of the public without unilateral change. It also requested a refund of hundreds of billions of shekels that were regularly taken from citizens' payment for future deficit coverage and without accountability and approval required by law from the National Insurance for these financial investments, and much about this was also written in the State Comptroller's Report in 2015. According to the previous actuarial forecast, the balance of the principal was expected to reset in 2044 and was advanced in this report to 2036 for various reasons including: the passing of necessary reforms to the disability pensions and long-term care benefits, the population growth and the high life expectancy in the State of Israel compared to the OECD countries.

According to the report, the Coronavirus crisis caused a decrease in the revenue of the National Insurance, both from the public and from the Treasury, as well as a decrease in the investments of the National Insurance in securities and subsequently – a decline in interest income.

At the same time, additional legislative changes have been passed that have affected the actuarial situation of the National Insurance Institute, such as the Insolvency and Economic Rehabilitation in the Event of Bankruptcy Law, raising women's retirement age under the Economic Efficiency Law in 2021, the coming into effect of the Rotation Arrangement in road accident compensation in which the insurance companies transfer a fixed amount of compensation paid to the public by the National Insurance, the Disability Reform passed after years without changing the benefit, as well as the Long-Term Care Reform which consolidated the responses within the National Insurance and did not disperse them among different entities, advanced the assistance in minor nursing situations to prevent deterioration, and brought the implementation and provision of rights that did not exist in the past.

It should be noted that according to the actuarial report, the dependency ratio of the elderly population is expected to increase from 25.5% in 2023 to 32.6% in 2065, which will require old-age pensions, and long-term care benefits paid to a person who needs help in daily activities (bathing, eating, etc.) and are subject to an income test. In other words, recipients of a long-term care benefit are people whose income is below the threshold set by law.

As noted, the actuarial report was presented this week to the Minister of Labor and the Finance Committee of the National Insurance Council, who requested to add up-to-date data to the report in order to reflect the current reality of the National Insurance's capacity to provide payments to the public. In addition, the Minister of Labor asked for the creation of a joint committee between the National Insurance Institute and the Ministry of Finance to discuss the issue and come up with solutions, in order to ensure the continued independence of the National Insurance and the continuation of payments to Israeli residents who paid insurance contributions throughout their lives. Among the solutions that have arisen in the past to improve the actuarial situation is a proportional and fair linkage of the retirement age to life expectancy, the government's participation in the payments of beneficiaries of exemptions and discounts on national insurance contributions, the return of funds taken from the National Insurance to the State Treasury, the proportionate increase in insurance contributions only in situations of accumulated deficit, and the retention of National Insurance surpluses without transferring them to the Treasury, and more.

- Minister of Labor, Yoav Ben Tzur: "The independence of the National Insurance and the continuation of payments to the residents of Israel are necessary in a moral and well-ordered society. The Israeli public has paid national insurance contributions all their lives and wants to go to sleep knowing that if anything happens – the National Insurance will be there for them and pay them all the rights they have accumulated over the years. I have instructed all relevant parties to sit together and try to come up with appropriate solutions, at the same time as making the clear statement that offsetting benefits will not occur under my watch. People in long-term care, senior citizens, people with disabilities, the unemployed, and so on, will not be harmed. Over the years, reforms have been passed in the legislation, and billions of shekels have been transferred - and this is a social, economic and moral issue that must be considered in order to ensure its continuity."

- Acting Director General of the National Insurance, Zvika Cohen: "The National Insurance is the root and social entity established in the days of Golda Meir, to ensure that every person who needs assistance will not depend on the mercy of others but will be provided assistance as a full right. This spirit and policy is a law in the State of Israel and that's a good thing. The Coronavirus crisis and the difficult war we are in only sharpens the need for an organization such as the National Insurance that provides a solution to the victims of hostile actions, the unemployed, senior citizens, people in long-term care, recipients of income support and more. In a reality in which the economic and security situation is constantly changing, Israeli citizens have to live with the knowledge that a social entity is there for them and that they have paid to ensure this. The actuarial status of the National Insurance is a topic that needs to be transparent to the public and to decision-makers in order to ensure that the residents of Israel are insured for many years to come."